Recapping the

DC Blockchain Summit 2019

Key Takeaways

Recapping the DC Blockchain Summit 2019

Key Takeaways

Thank you to everyone who joined us at the fourth annual DC Blockchain Summit!

The first day included a presentation on our National Action Plan for Blockchain from Perianne Boring, President and Founder, and Amy Davine Kim, Chief Policy Officer, Chamber of Digital Commerce. The core ideas of the National Action Plan for Blockchain were reiterated throughout the event, focusing on elevating blockchain to a national priority on par with artificial intelligence, quantum computing, and 5G wireless technologies. The fact that government’s role should be limited was also emphasized by some presenters such as SEC Commissioner Hester Peirce who said she thinks the Chamber’s efforts to promote a national action plan are helpful. She also cautioned that innovation in blockchain comes primarily from industry — an excellent point that we acknowledge in the first Principle in our National Action Plan (the private sector should lead) and with which we passionately agree!

Our regulators panel was a standing room only event involving the government officials whom are at the heart of some of the most complex issues facing our members today — Daniel Gorfine, CFTC Chief Innovation Officer and LabCFTC Director; Kavita Jain, Director of Office of Emerging Regulatory Issues, FINRA; Jessica Renier, Senior Advisor on Domestic Finance, U.S. Dept. of the Treasury; and Valerie Szczepanik, Senior Advisor for Digital Assets & Innovation, U.S. SEC. Each panelist invited companies to share information about their products and services and areas of friction they experience so they could work with them to come up with appropriate solutions.

On the second day, we heard from Congressman Tom Emmer, Co-Chair, Congressional Blockchain Caucus (R-MN), who recognized that “the Chamber is in the best position to represent the many diverging branches of the blockchain ecosystem and unify the industry.” Congressman Emmer supported the Chamber’s proposed National Action Plan for Blockchain and reminded his colleagues in government to take pause and consider ways to support the technology’s growth rather than impede it. Erik Bethel, Executive Director, The World Bank concluded the Summit by discussing how the organization is examining the use of blockchain for financial inclusion and infrastructure projects globally.

Key themes from our government speakers included harmonizing regulatory regimes and modernizing laws to keep pace with innovators. They shared their views on the importance of engaging with industry stakeholders to enable them to explore and build public and private solutions using blockchain. Commissioner Peirce directly asked the audience to come in to the SEC to share their perspectives, use cases, and areas of friction.

Here’s what our government speakers had to say:

Congressman Tom Emmer, Co-chair, Congressional Blockchain Caucus said, “As the Chamber of Digital Commerce has outlined, before we stifle, we must encourage the private sector to develop these technologies. The National Action Plan also provides a needed call for clear regulation prior to enforcement.”

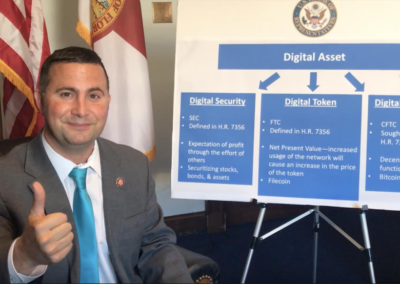

Congressman Darren Soto, Co-chair, Congressional Blockchain Caucus, in a remote address to Summit attendees, said, “We’re doing everything we can to have a light-touch regulatory scheme, to make sure we are creating certainty, but also fostering innovation and making sure government stays out of your way as best we can.” He concluded by thanking innovators for, “forging ahead for America’s economy and America’s future,” and stated, “we’ll keep working together.”

Commissioner Hester Peirce, U.S. Securities and Exchange Commission explained to the audience that, “Regulators are slow, so you shouldn’t expect any kind of quick activity. Certainly not, in terms of – everything is relative. For our world, we might be moving very quickly but for your world it’s going to look slow. But I do think there’s a learning curve, so people at the SEC are trying to learn about this space and trying to understand where the pressure points are – where the pain points are – so you all need to come in and tell us where the pain points are, where the old regime doesn’t fit.”

She also said, “We need to have clear regulatory guidelines…we need to tell people where they stand.”

Chairman J. Christopher Giancarlo, U.S. Commodity Futures Trading Commission acknowledged the work of the Chamber, “it is great to be part of this program put on by the Chamber of Digital Commerce, an organization that brings so much intelligence to the public discussion of digital assets and Blockchain technology. My thanks to Perianne Boring, who is truly one of the foundational figures in this emerging field of innovation… I am grateful to organizations like the Digital Chamber that have been engaged with us along the way. They are a trusted resource, as we see in their thoughtful response to our request for information on crypto markets and mechanics.”

And discussed how, “The digitization of virtually everything…means the decentralization of everything. It means the atomization of traditional ecosystems into their smallest component parts which is especially challenging for traditional approaches to regulation.”

“So, what should your approach be as innovators? My advice to you is this: Keep going! Solve problems. Innovate boldly, innovate with integrity and innovate intelligently. Get competent advice. Follow the law. Keep going. Do not be afraid.”

He concluded by saying, “Recognize that while our regulations were designed for environments that have been transformed, the principles underlying our regulations remain relevant – and remain enforceable. So work with us. Talk to us. Interact with LabCFTC and work with our regulatory divisions.

Counselor Craig Phillips of the U.S. Dept. of the Treasury explained how Treasury is, “probing how innovative technologies like blockchain and AI relate with the regulatory system. We need to regulate with the pace of technological growth in mind.”

He also said, “the government is unlikely to be at all compromising and it’s again kind of a show stopper where you can have 99 things go great and if there’s 1 really serious incident involving national security, terrorism, or money laundering. It becomes kind of a show stopper for the evolution [of digital assets].”

Under Secretary Manisha Singh of the U.S. Dept. of State observed, “In the public sector, this technology could enable improvements to things like data collection for the U.S. census. It could streamline some of the basic functions of government for the benefit of the citizens we serve. And we all know that government can certainly be more efficient! It’s an opportunity to improve public trust and confidence in the information managed by the government.”

She also pointed out that the Department of State, “understand[s] the importance of a coordinated whole of government approach to ensuring American competitiveness in this technology. We very much appreciate the Digital Chamber providing us with a potential blueprint in their National Action Plan – it is something we are reviewing as a set of guiding principles.”

Erik Bethel, Executive Director, The World Bank discussed how The World Bank attempted to solve the problem of high costs associated with borrowing money by issuing the bond on a blockchain, known as bond-i.

On the prospect of future opportunities at the World Bank, he offered, “What if instead of sending $200 million, we sent $200 million in World Bank tokens” to trace money and ensure that the appropriate people are receiving the funds.

Key themes from our industry speakers included taking time to build during Crypto Winter to get a running start into Crypto Spring. Industry leaders discussed how they are building applications that impact an array of sectors.

Here’s what our Industry speakers had to say:

Anoop Nannra, Head of Blockchain, Cisco

As he discussed the importance of the National Action Plan for Blockchain, Anoop asked how we can turn it into a blueprint for global innovation. He asked, “how do we make this a document for the Western Hemisphere…in a public-private partnership with governments around the world? How do we build momentum around all of this?”

Later, his colleague Al Lynn, Vice President of Engineering, Cisco, gave insight into how blockchain can help protect digital identity and can be applied to defense communications by moving from two-factor authentication processes to seven-factor identity authentication schemes in the future.

Brad Garlinghouse, CEO, Ripple pointed out that, “We’ve been asked as an industry not to speed, but we weren’t given a speed limit.”

Matthew Roszak, Co-founder & Chairman, Bloq predicted, “The overcurrent will be super positive and good for the tokenization economy that’s ahead of us. The undercurrent of tokens in our rearview mirror will come back into focus.” Right now, STOs are “in full bloom.”

Jonathan Johnson, President, Medici Ventures, looking back at the early days of e-commerce to see where blockchain is heading, said, “We have seen that perceptions change. I remember when people were more comfortable calling someone and reading out their credit cards, not filling it in in the form online. Today that would not happen.”

Bernie Moreno, CEO, Ownum offered a glimpse into the future and told the audience to, “Imagine sending a [car] title in the same way you can send a text message.”

Brendan Blumer, CEO, Block.one, stated, “Data is the new oil and it’s floating around in ways companies can’t protect. It’s being spilled in ways that can’t be controlled.”

Stephen Pair, CEO, BitPay theorized, “Eventually, most transaction databases will become blockchain databases.”

EVENTS

CONTACT

LEGAL

BE PART OF A UNIFIED VOICE FOR THE BLOCKCHAIN TECHNOLOGY ECOSYSTEM